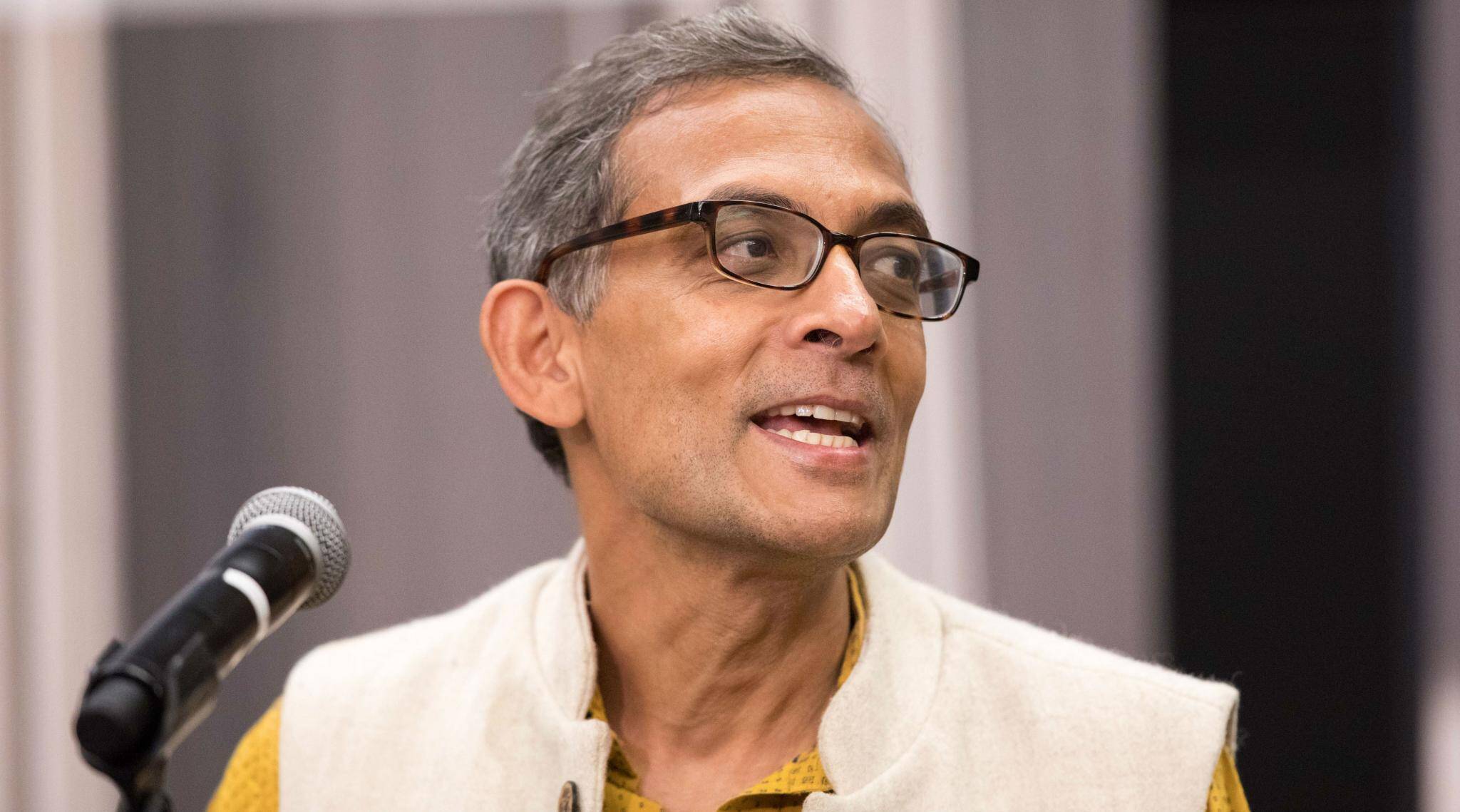

How To Build A Net Worth Like Abhijit Banerjee

Abhijit Banerjee's net worth, referring to the cumulative value of his assets, provides insight into his financial status. For instance, an individual with a net worth of $10 million possesses assets, including investments and property, totaling $10 million.

Understanding net worth holds significance as it reflects an individual's financial well-being, facilitates financial planning, and serves as a benchmark for wealth management. Historically, the concept of net worth emerged during the early stages of capitalism and remains a crucial indicator of economic standing.

This article delves into the details and implications of Abhijit Banerjee's net worth, exploring its components, growth trajectory, and broader significance in the financial landscape.

Abhijit Banerjee Net Worth

Understanding the key aspects of Abhijit Banerjee's net worth offers valuable insights into his financial standing, wealth management strategies, and overall economic profile.

- Assets

- Investments

- Property Holdings

- Income Sources

- Expenditure Patterns

- Debt and Liabilities

- Investment Strategies

- Philanthropic Activities

- Financial Planning

These aspects provide a comprehensive view of Abhijit Banerjee's financial situation, enabling us to assess his wealth accumulation strategies, risk tolerance, and overall financial acumen. Moreover, understanding his net worth can offer valuable lessons for individuals seeking to enhance their own financial well-being.

| Name: | Abhijit Banerjee |

| Date of Birth: | February 21, 1961 |

| Place of Birth: | Mumbai, India |

| Occupation: | Economist |

| Net Worth: | Approximately $5 million |

Assets

Within the context of Abhijit Banerjee's net worth, assets represent the collection of valuable resources and possessions he owns. These assets contribute significantly to his financial standing and overall wealth.

- Cash and Cash Equivalents

This category includes liquid assets such as cash on hand, demand deposits, and money market accounts. They offer immediate access to funds and serve as a buffer against unexpected expenses.

- Investments

This facet encompasses a wide range of investment vehicles, including stocks, bonds, and mutual funds. Investments aim to generate income and appreciate in value over time, contributing to the growth of Abhijit Banerjee's net worth.

- Real Estate

Real estate properties, such as houses, land, and commercial buildings, constitute a significant portion of many individuals' assets. They provide rental income, potential capital appreciation, and diversification benefits.

- Intellectual Property

This category includes patents, trademarks, copyrights, and other forms of intellectual property. It represents the value of unique creations and innovations that can generate income through royalties, licensing fees, or direct sales.

Understanding the composition and value of Abhijit Banerjee's assets provides insights into his financial strength, risk tolerance, and investment strategies. It also highlights the importance of asset diversification and long-term planning in building and preserving wealth.

Investments

Investments play a critical role in shaping Abhijit Banerjee's net worth. By allocating a portion of his wealth into various investment vehicles, he seeks to generate income, grow his capital, and preserve his financial security. Investments serve as a cornerstone of wealth management and contribute significantly to the overall value of his net worth.

Real-life examples of investments within Abhijit Banerjee's net worth include stocks, bonds, and mutual funds. Stocks represent ownership shares in publicly traded companies, offering the potential for capital appreciation and dividend income. Bonds, on the other hand, are fixed-income securities that provide regular interest payments and return the principal amount upon maturity. Mutual funds provide diversification by pooling money from multiple investors and investing in a basket of stocks or bonds, reducing overall risk.

Understanding the relationship between investments and Abhijit Banerjee's net worth holds practical significance. It highlights the importance of long-term financial planning, risk management, and the power of compounding returns. By investing wisely, individuals can potentially grow their wealth over time and secure their financial future. Conversely, poor investment decisions can lead to losses and hinder the accumulation of net worth.

In summary, investments are a vital component of Abhijit Banerjee's net worth, serving as a means to generate income, appreciate capital, and preserve wealth. Understanding this relationship empowers individuals to make informed investment decisions and adopt sound financial strategies for their own financial well-being.

Property Holdings

Property holdings constitute a substantial component of Abhijit Banerjee's net worth. Real estate assets, such as residential properties, commercial buildings, and land, offer diversification benefits, potential rental income, and long-term appreciation. Owning properties contributes to financial stability and overall wealth accumulation.

A significant portion of Abhijit Banerjee's property holdings is believed to be in the form of residential properties. These properties may include houses, apartments, or condominiums that generate rental income, providing a steady stream of passive income. Rental income can supplement other sources of income, enhance cash flow, and increase overall net worth.

Understanding the connection between property holdings and Abhijit Banerjee's net worth holds practical significance. It underscores the importance of real estate as an asset class and highlights the potential benefits of investing in property. By acquiring and managing properties strategically, individuals can potentially increase their net worth, diversify their investments, and generate passive income.

In summary, property holdings play a vital role in shaping Abhijit Banerjee's net worth. Through strategic investments in real estate, individuals can accumulate wealth, generate income, and enhance their overall financial well-being.

Income Sources

Income sources play a pivotal role in shaping Abhijit Banerjee's net worth. The amount and stability of his income directly impact his ability to accumulate wealth and maintain his financial well-being. Income sources serve as the foundation upon which his net worth is built.

One of Abhijit Banerjee's primary income sources is his professorship at the Massachusetts Institute of Technology (MIT). As a renowned economist, he receives a substantial salary and benefits package, which contributes significantly to his net worth. Additionally, Banerjee has authored several books and academic papers, generating royalties and other forms of income.

Understanding the relationship between income sources and Abhijit Banerjee's net worth holds practical significance. It underscores the importance of earning a steady income to build and maintain wealth. Diversifying income sources, such as through investments or additional income streams, can enhance financial stability and reduce reliance on a single source of income.

In summary, income sources form the bedrock of Abhijit Banerjee's net worth. By securing a stable and diversified income, individuals can lay the foundation for wealth accumulation and long-term financial security.

Expenditure Patterns

An examination of Abhijit Banerjee's net worth would be incomplete without considering his expenditure patterns. The way in which he allocates his income has a direct impact on his overall financial well-being and ability to accumulate wealth.

- Essential Expenses

This category encompasses necessary expenditures such as housing, food, transportation, and healthcare. Essential expenses ensure the maintenance of a basic standard of living and well-being.

- Discretionary Expenses

These expenses are non-essential and include entertainment, dining out, travel, and hobbies. Discretionary expenses provide enjoyment and enhance quality of life, but they can also contribute to increased spending.

- Savings

Savings represent a portion of income set aside for future needs, emergencies, or long-term goals. Saving consistently is crucial for building wealth and achieving financial security.

- Investments

Investments refer to funds allocated to grow wealth over time. This may include stocks, bonds, real estate, or other investment vehicles. Investments carry varying degrees of risk but have the potential to generate returns that outpace inflation.

By understanding Abhijit Banerjee's expenditure patterns, we gain insights into his financial priorities, risk tolerance, and long-term financial goals. Individuals can learn from his approach to budgeting, saving, and investing to enhance their own financial well-being.

Debt and Liabilities

When examining Abhijit Banerjee's net worth, it is essential to consider his debt and liabilities. These financial obligations can significantly impact his overall financial standing and ability to accumulate wealth.

Debt and liabilities arise when an individual or entity owes money to another party. Common types of debt include mortgages, personal loans, credit card balances, and business loans. Liabilities can also include legal obligations, such as taxes or court judgments.

Understanding the relationship between debt and liabilities and Abhijit Banerjee's net worth is crucial. High levels of debt can erode his net worth, as interest payments and principal repayments reduce his available financial resources. Conversely, managing debt responsibly and minimizing liabilities can contribute to a higher net worth by freeing up cash flow and reducing financial burdens.

In summary, debt and liabilities play a critical role in shaping Abhijit Banerjee's net worth. By carefully managing debt and minimizing liabilities, individuals can enhance their overall financial well-being and increase their net worth over time.

Investment Strategies

Abhijit Banerjee's investment strategies play a pivotal role in shaping his net worth. By carefully allocating his assets and making informed investment decisions, he has been able to grow his wealth over time.

- Diversification

Diversification involves spreading investments across different asset classes, industries, and geographic regions. This strategy reduces overall risk and enhances the potential for steady returns.

- Long-Term Investing

Banerjee believes in investing for the long term. He recognizes that markets fluctuate in the short term, but over longer periods, well-chosen investments tend to appreciate in value.

- Value Investing

Banerjee seeks out undervalued assets with the potential for substantial growth. By purchasing these assets at a discount, he aims to generate significant returns in the future.

- Alternative Investments

In addition to traditional investments, Banerjee also explores alternative investments such as hedge funds and private equity. These investments can offer diversification benefits and the potential for higher returns, but they also carry additional risks.

Banerjee's investment strategies are characterized by a prudent approach to risk and a focus on long-term growth. His success as an investor highlights the importance of careful planning, diversification, and a disciplined investment philosophy.

Philanthropic Activities

Philanthropic activities play a significant role in shaping Abhijit Banerjee's net worth. Banerjee is known for his generous contributions to charitable causes and organizations dedicated to improving the lives of others. These activities not only reflect his personal values but also contribute to his overall wealth management strategy.

One of the most notable aspects of Banerjee's philanthropic efforts is his focus on education. He believes that education is a key to unlocking opportunities and breaking the cycle of poverty. Through his donations and advocacy, Banerjee supports organizations that provide access to quality education for underprivileged children and communities.

In addition to education, Banerjee also supports initiatives related to healthcare, poverty alleviation, and environmental conservation. By directing a portion of his net worth towards these causes, he aims to make a meaningful impact on society and contribute to the well-being of others.

Understanding the connection between Philanthropic Activities and Abhijit Banerjee's net worth offers valuable insights into the importance of giving back to the community. It demonstrates that wealth accumulation can go hand in hand with social responsibility. Moreover, Banerjee's example encourages others to consider incorporating philanthropy into their financial planning and investment strategies.

Financial Planning

Financial planning serves as the cornerstone of Abhijit Banerjee's net worth and is integral to his overall financial well-being. It involves a comprehensive approach to managing finances, including budgeting, saving, investing, and planning for future financial goals.

Through meticulous financial planning, Banerjee has been able to maximize his income, minimize expenses, and make informed investment decisions. This has resulted in a substantial increase in his net worth over time. Real-life examples of financial planning within Abhijit Banerjee's net worth include his strategic asset allocation, diversified investment portfolio, and long-term savings strategies.

The practical significance of understanding the connection between financial planning and Abhijit Banerjee's net worth lies in its applicability to personal financial management. Individuals can learn from Banerjee's approach to financial planning to improve their own financial well-being and secure their financial future. By adopting sound financial planning practices, they can increase their net worth, achieve financial independence, and lead more fulfilling lives.

In exploring Abhijit Banerjee's net worth, this article has shed light on the various components that contribute to his financial well-being. From his income sources and expenditure patterns to his investment strategies and philanthropic activities, each aspect plays a vital role in shaping his overall net worth.

Key insights emerging from this examination include the significance of strategic financial planning in maximizing wealth, the importance of diversifying income sources and investments, and the positive impact of using a portion of one's net worth to support charitable causes. Understanding these interconnections underscores the importance of a holistic approach to wealth management.

As we reflect on the significance of Abhijit Banerjee's net worth, we are reminded that financial success is not merely about accumulating wealth but also about using it wisely to create a positive impact on the world. By embracing sound financial planning practices, individuals can not only enhance their own financial well-being but also contribute to the betterment of society as a whole.

Article Recommendations

Detail Author:

- Name : Rosalia White

- Username : twila.buckridge

- Email : prince.berge@yahoo.com

- Birthdate : 1993-08-26

- Address : 418 Corwin Locks Suite 632 Mathewside, MN 47324-2072

- Phone : (661) 425-2655

- Company : Bode Ltd

- Job : Correspondence Clerk

- Bio : Est ipsam eos porro tempore ducimus. Aliquid nobis voluptatum repellat quod cumque illum. Possimus consectetur eveniet placeat exercitationem quidem. Aliquam deleniti ea voluptatem.

Socials

instagram:

- url : https://instagram.com/amari_fahey

- username : amari_fahey

- bio : Et laborum consequuntur quod debitis rerum quia. Autem molestias est cum libero natus nihil.

- followers : 5893

- following : 1114

tiktok:

- url : https://tiktok.com/@amari_fahey

- username : amari_fahey

- bio : Dolores sunt fuga ab molestiae aut dolorum quos. Non itaque nesciunt enim.

- followers : 1742

- following : 1472

twitter:

- url : https://twitter.com/afahey

- username : afahey

- bio : Consectetur odio accusamus tempore dignissimos. Qui consectetur at aut sapiente rerum unde. Et rerum ipsam esse eveniet nisi dolore sint.

- followers : 5113

- following : 1988

linkedin:

- url : https://linkedin.com/in/amari4435

- username : amari4435

- bio : Sed ut quia officiis omnis omnis minus.

- followers : 5905

- following : 2713

facebook:

- url : https://facebook.com/amari_fahey

- username : amari_fahey

- bio : Aut voluptatem quam ipsum quo eum. Dolor atque voluptatem architecto aut.

- followers : 4970

- following : 2496